Choosing the right retirement account is a critical financial decision. The debate between a Roth IRA vs. Traditional IRA centers on one key question: do you want your tax break now or later? This guide will dissect the differences in tax treatment, rules, and ideal scenarios. You’ll gain the clarity needed to choose the account that best aligns with your current finances and future goals.

The Core Difference: Tax Timing

Understanding the fundamental tax mechanics is essential. This difference defines every other rule and benefit.

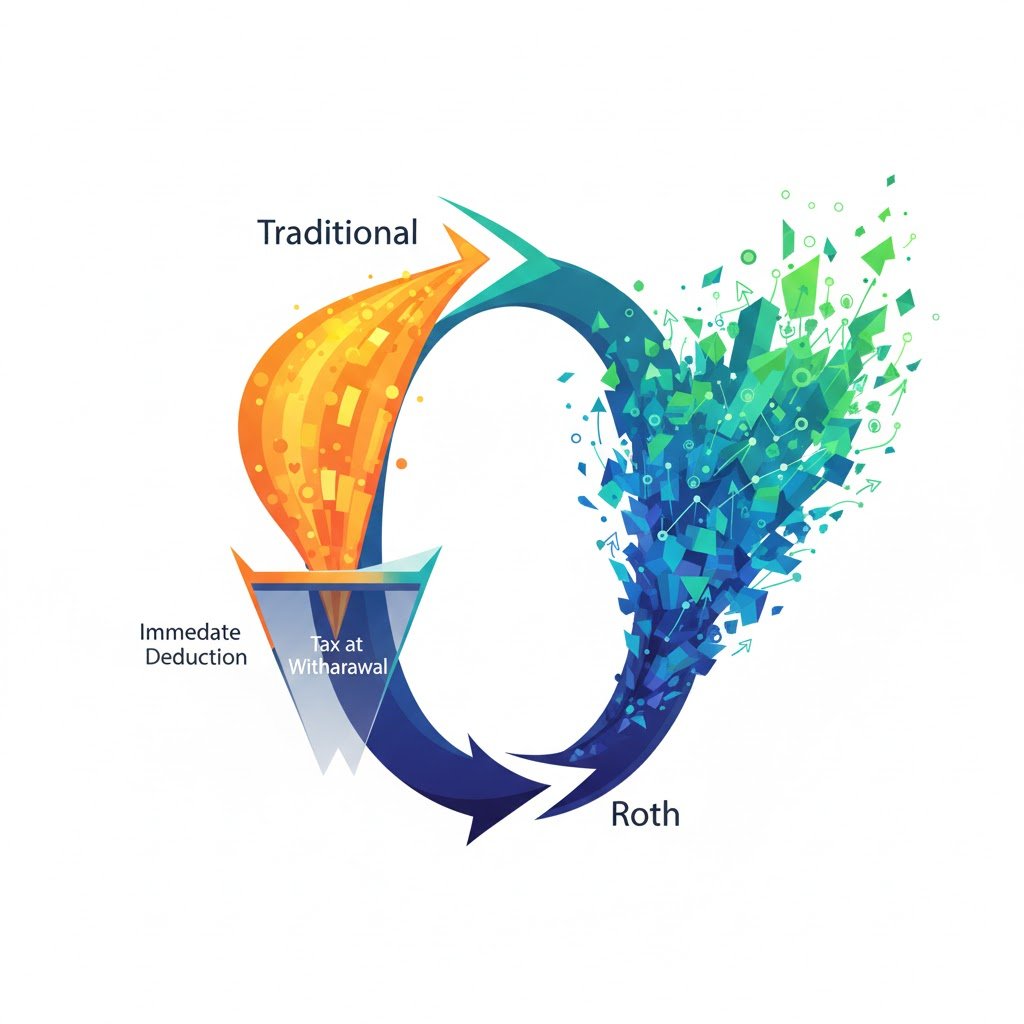

A Traditional IRA offers a tax break today. Your contributions are often tax-deductible, lowering your taxable income for the year you contribute. Your money grows tax-deferred. You pay ordinary income tax on both your contributions and earnings when you withdraw in retirement.

Conversely, a Roth IRA offers a tax break tomorrow. You contribute with after-tax dollars, so there’s no immediate deduction. However, your investments grow completely tax-free. Qualified withdrawals in retirement—including all those years of earnings—are entirely tax-free. This foundational choice between an immediate deduction and future tax-free growth is the heart of the Roth vs Traditional IRA decision.

Key Rules and Restrictions to Know

Beyond taxes, specific rules govern eligibility, access, and required withdrawals. These practical details often sway the decision.

First, consider income limits. For 2024/2025, Roth IRA contributions phase out at higher income levels. If you earn too much, you may be ineligible to contribute directly. The Traditional IRA has no income limits to contribute, but deductibility may phase out if you or your spouse are covered by a workplace plan like a 401(k).

Next, examine withdrawal rules. A Traditional IRA mandates Required Minimum Distributions (RMDs) starting at age 73 or 75. You must withdraw and pay taxes on money you may not need. The Roth IRA has no RMDs for the original owner, allowing your savings to grow untouched indefinitely. This makes it a powerful tool for estate planning and a flexible component of your step-by-step path to financial freedom.

How to Choose Based on Your Situation

There is no universal “better” account. The optimal choice depends on your personal financial picture and predictions about the future.

Deciding Between a Roth or Traditional IRA

Your current vs. future tax bracket is the most important factor. If you believe your tax rate will be higher in retirement, the Roth IRA is generally advantageous. You lock in today’s lower rate. If you expect your tax rate to be lower in retirement, the Traditional IRA allows you to defer taxes to that future, lower rate.

Furthermore, consider your age and time horizon. Younger investors in lower tax brackets are prime candidates for a Roth. They have decades for tax-free growth and likely expect higher future earnings. Those nearing retirement in their peak earning years may benefit more from the immediate tax deduction of a Traditional IRA. For foundational knowledge on building a portfolio within either account, our guide on how to start investing with $100 covers essential beginner principles.

Strategic Considerations and Advanced Tips

Sometimes, the decision isn’t straightforward. Advanced strategies can help you maximize benefits regardless of your choice.

You can contribute to both IRA types in the same year, as long as your total contributions don’t exceed the annual limit. This “tax diversification” strategy hedges your bets against future tax law changes. Additionally, high-income earners blocked from direct Roth contributions can use a “Backdoor Roth IRA” strategy, which involves a non-deductible Traditional IRA contribution followed by a conversion.

Always prioritize an employer 401(k) match first—it’s free money. Then, fund your IRA. When researching providers like Vanguard or Fidelity, use authoritative resources. For understanding how to evaluate financial information online, Google’s guide to evaluating page experience highlights factors for credible, user-friendly sites. For strategic retirement planning frameworks, the HubSpot Blog’s Strategy Section offers valuable insights on long-term goal setting.

Common Pitfalls and Mistakes to Avoid

Awareness of common errors can protect your savings and your tax strategy.

A major mistake is ignoring the pro-rata rule if you attempt a Backdoor Roth IRA while having other pre-tax IRA money. This can trigger unexpected taxes. Another error is taking early withdrawals from a Traditional IRA and incurring a 10% penalty plus income taxes, derailing your retirement growth.

Finally, don’t let indecision paralyze you. Saving in a tax-advantaged account is more important than choosing the theoretically perfect one. You can often change strategies later via conversions. The act of starting is the most critical step toward securing your passive income ideas in retirement.

Don’t let complexity delay your retirement savings. Assess your tax situation, choose the IRA that aligns with your outlook, and open your account this week.